86-27-84738038/84738036

English

English

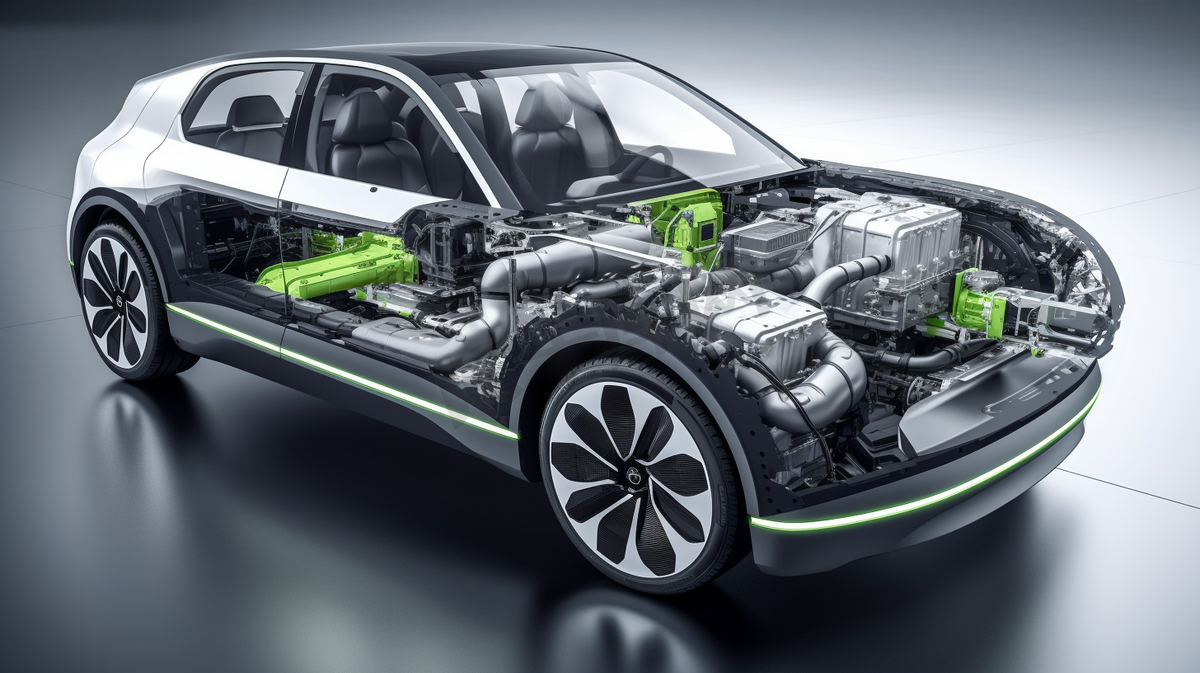

The "nervous system" of new energy vehicles is driving a small but exquisite market to quietly explode, presenting domestic enterprises with an opportunity for substitution.

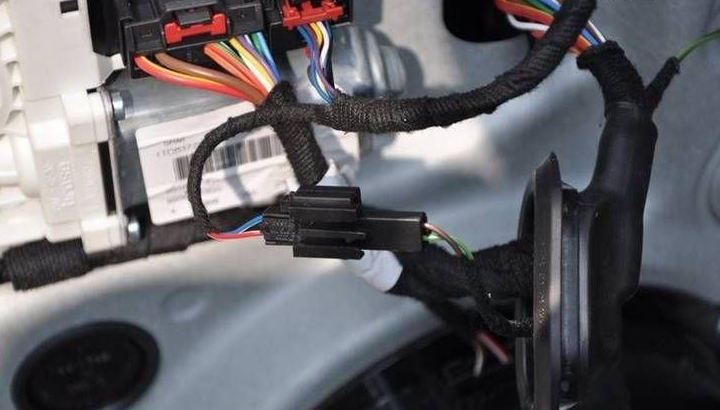

Automotive wiring harnesses are known as the "neural networks" of a car, and wiring harness tape is the key material for protecting these neural networks. With the continuous increase in the production and sales of new energy vehicles in China, the market demand for high-voltage wiring harness tapes has witnessed explosive growth.

According to industry data, the market size of wiring harness tape in China's new energy vehicle sector reached 381 million yuan in 2022, surging by 102.66% year-on-year and accounting for 24.3% of the entire wiring harness tape market. This growth trend continues to accelerate as the penetration rate of new energy vehicles increases.

01 Market status quo: New energy drives demand transformation

The market size of China's automotive wiring harness tape industry has grown from 1.251 billion yuan in 2016 to 1.721 billion yuan in 2023, showing a stable growth trend overall. However, the structural changes are more significant. The market for wiring harness tapes in traditional fuel vehicles has declined, while the new energy vehicle sector has grown rapidly...

The demand for wiring harness tapes in new energy vehicles varies significantly. Compared with traditional fuel vehicles, the high-voltage wiring harness tape for new energy vehicles has higher requirements. It needs to have properties such as high-temperature resistance, flame retardancy, wear resistance, and corrosion resistance. Its price is 20% to 30% higher than that of traditional tape.

In terms of product performance, the high-voltage wiring harness tape for new energy vehicles needs to meet more stringent working environment requirements. The wiring harness tape in the engine compartment needs to withstand a temperature range of -40℃ to 150℃, and the temperature in the driver's cabin should reach 85-105℃. This high-performance requirement has also led to an increase in product value.

02 Competitive Landscape: Opportunities for Domestic Substitution Led by Foreign Capital

At present, the global wire harness tape market is highly concentrated, with four foreign enterprises, Tesa, 3M, Nitto Denko and DIC, holding a dominant position. These international brands, relying on their technological accumulation and brand advantages, have long monopolized the high-end market.

Chinese automotive wiring harness tape enterprises can be divided into three tiers: The first is foreign-funded enterprises represented by Tesa, which have strong technical strength; The second is domestic well-known enterprises represented by Yongle Tape, etc. The third category is a large number of small and medium-sized enterprises.

|

|

|

|

|

|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

03 Investment Hotspot: Special tapes for new energy become a new blue ocean

The market for high-voltage wiring harness tapes in new energy vehicles has become a key area of focus for capital. It is predicted that the market size of wiring harness tapes for new energy vehicles will exceed 2 billion yuan in 2025 and is expected to reach 4.5 billion yuan by 2030. This growth trend has attracted a large number of enterprises to increase their investment and layout.

The investment directions mainly focus on three major areas: The research and development of high-end products such as high-temperature resistant and halogen-free flame-retardant types have become the investment priorities. Investment in the research and development of environmentally friendly solvent-free adhesives has continued to increase. In 2023, the industry's R&D investment intensity reached 3.2%, an increase of 0.8 percentage points compared with 2019.

In terms of regional investment layout, the Yangtze River Delta and the Pearl River Delta together account for 65% of the market share, but the central and western regions are catching up at an average annual growth rate of 12%. The newly-built electronic industrial parks in Chongqing, Xi 'an and other places have attracted many leading enterprises to set up production bases.

04 Technological Trends: High performance and environmental protection advancing in parallel

The technical requirements for wiring harness tapes in new energy vehicles are increasing day by day. High-temperature resistance has become a basic requirement. The maximum storage temperature in some parts of the engine compartment can reach 135℃, so the tape must withstand temperatures above 130℃.

Environmental protection is another important trend. The Ministry of Industry and Information Technology's "Normative Conditions for the Green Packaging Industry" clearly stipulates that solvent-based adhesive processes should be phased out by 2027. Water-based adhesive technology is expected to achieve large-scale application by 2026, and the proportion of environmentally friendly products will exceed 50%.

Innovative technologies keep emerging. The UV/EB green curing process can achieve rapid curing, significantly reducing the use of solvents and VOCs emissions. The conversion rate of innovative achievements such as nano-modification technology and UV curing process has increased to 34%, promoting the high-quality development of the industry.

05 Challenges and Risks: Cost and supply chain security coexist

The automotive wiring harness tape industry is under pressure where the cost of raw materials accounts for more than 75% of the total product cost. The price fluctuations of major raw materials such as butyl acrylate have a significant impact on business operations. In 2023, the average price of PVC resin rose by 18% year-on-year.

There are potential risks to supply chain security. The import dependence on high-end PET films has long remained above 45%, and some key materials still rely on imports. The uncertainties brought about by changes in the international trade environment and the US Section 301 tariff list against China, which involves some electronic tape products, have affected export business.

The risk of technological substitution cannot be ignored. The maturity of new connection technologies such as nano-silver conductive adhesives may divert 10% to 15% of the market demand for traditional conductive tapes in the next five years. Enterprises need to continuously innovate to cope with the risks of technological iteration.

In the next five years, with the continuous development of the new energy vehicle industry, the automotive wiring harness tape industry will undergo a structural upgrade. By 2030, the proportion of environmentally friendly products will exceed 50%, and intelligent manufacturing technology will reduce the product defect rate to 0.3‰.

Domestic enterprises such as Yongguan New Materials and Yongle Tape are enhancing their competitiveness in the high-end market by increasing investment in research and development and expanding production capacity. With the acceleration of the domestic substitution process, the Chinese automotive wiring harness tape industry is expected to occupy an important position in the global market.

The Small but Crucial Automotive Wiring Harness Tape is Breaking the Foreign Monopoly Pattern with the New Energy Wave, and Domestic Enterprises are Emerging

11.25.2025

The Market for Wiring Harness Tapes for New Energy Vehicles in China has Seen a Sharp Increase, and the Investment Scale is Expected to Exceed 2 Billion Yuan by 2025

12.29.2025

The Automotive Wiring Harness Tape Industry is Undergoing Transformation, with Green Innovation and Domestic Substitution Becoming the Main Themes

10.29.2025

Contact Number86-27-84738038/84738036

Building 24,Xingsheng Road NO.155, Huading Industrial Park, Hannan Economic Development Zone, Wuhan City, Hubei Province

Building 24,Xingsheng Road NO.155, Huading Industrial Park, Hannan Economic Development Zone, Wuhan City, Hubei Province

jianzhongniu@lantortape.com

jianzhongniu@lantortape.com

Official Tiktok

Copyright ©2026.All Rights Reserved.Hubei ICP No. 2025129814-1

Lantor Technology (Hubei) Co., Ltd CopyrightTechnical Support: Shenyang Cloud Technology Co., Ltd