86-27-84738038/84738036

English

English

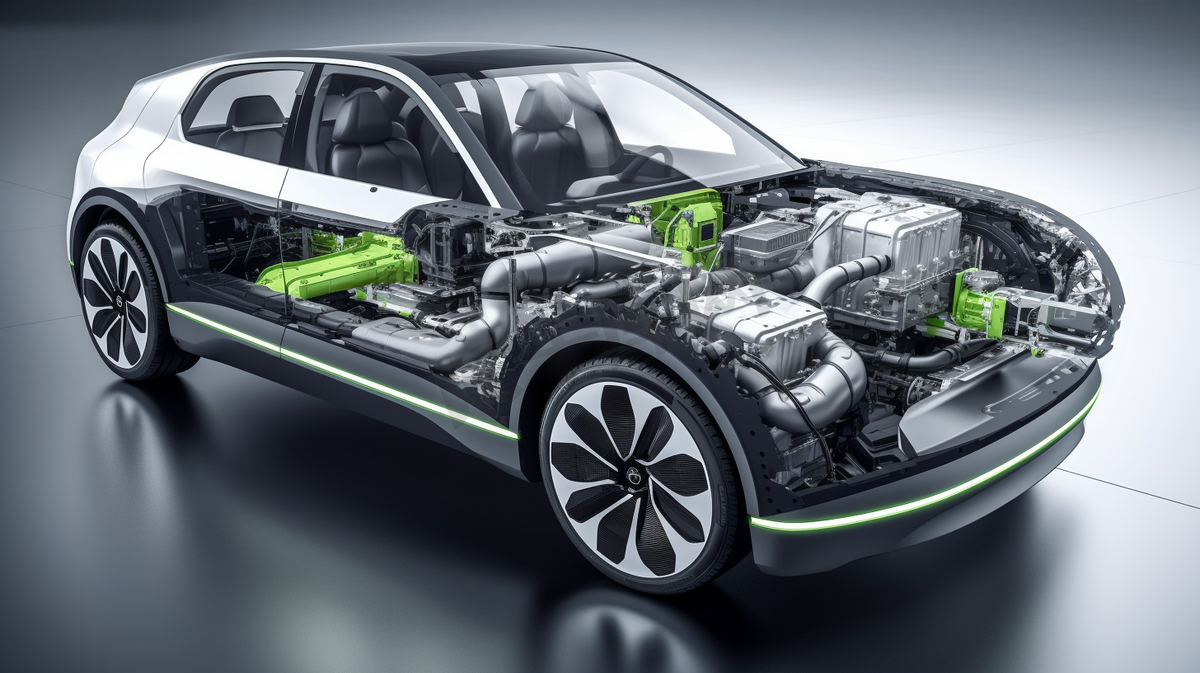

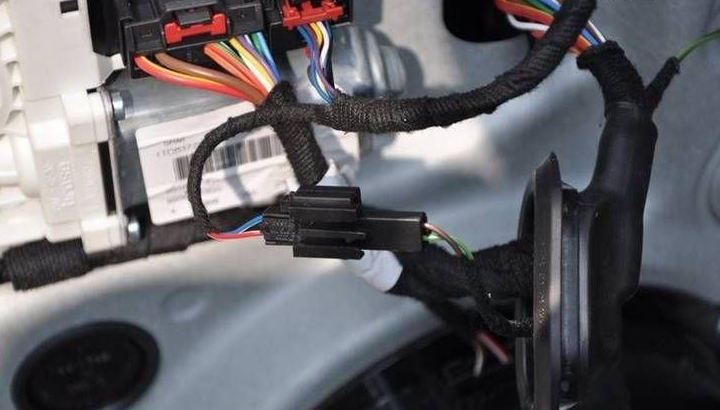

In an automotive wiring harness tape production workshop in East China, workers are busy packing and boxing a batch of newly produced tape products. These seemingly ordinary tapes are actually the "protective clothing" for the car's nervous system, with a value of 30 to 50 yuan per vehicle.

With the acceleration of the localization process of new energy vehicles, this industry, which was once monopolized by four foreign enterprises - Tesa, 3M, Nitto Denko and DIC - for 85% of the market share, is now undergoing structural changes.

01 Market status: Opportunities for domestic substitution under the dominance of foreign capital

The market size of China's automotive wiring harness tape industry has grown from 1.251 billion yuan in 2016 to 1.721 billion yuan in 2023, showing a stable growth trend. In 2022, the market size of automotive wiring harness tapes in China increased to 1.567 billion yuan, representing a year-on-year growth of 7.04% compared with 2021.

From the perspective of regional distribution, the East China region is the area with the largest proportion of automobile production in China and also the region with the greatest demand for automotive wiring harness tapes. In 2022, the market size of automotive wiring harness tape in East China accounted for 32.9%.

The global wire harness tape market is basically dominated by Tesa, 3M, Nitto Denko and DIC, which have long monopolized the Chinese market. Domestic automakers are expected to achieve a leapfrog development by taking advantage of the trend of new energy vehicles, which will accelerate the localization process of auto parts.

The rapid development of new energy vehicles has driven the recovery of China's auto production and sales. In 2024, China's cumulative auto sales reached 31.436 million units, representing a year-on-year growth of 4.46%. The development of the automotive industry and the increasing degree of automotive automation have stimulated the growth in demand for automotive wiring harness tapes.

02 Industrial Chain and Supply and Demand: Coexistence of raw material cost pressure and demand expansion

The upstream raw materials of the automotive wiring harness tape industry include PVC, PET, rubber, acrylic pressure-sensitive adhesive, nonwoven wool-polyester fabric, etc. The midstream is the manufacturing of automotive wiring harness tapes; The downstream application is in the automotive industry.

The proportion of raw material costs in the total product costs exceeds 75%, and the price fluctuations of major raw materials such as butyl acrylate have a significant impact on the operation of enterprises. In 2024, the proportion of direct material costs in all types of tapes will exceed 75%, and the product costs are significantly influenced by material prices.

In terms of supply and demand, the output of automotive wiring harness tape in China increased from 52.89 million square meters in 2016 to 89.86 million square meters in 2022. The demand for automotive wiring harness tape increased from 149.82 million square meters in 2016 to 171.82 million square meters in 2022.

With the gradual weakening of the impact of the epidemic, especially driven by the rapid development of the new energy vehicle industry, the production and sales volume of automobiles in China began to recover during 2021-2022, which in turn boosted the demand for automotive wiring harness tapes in China.

03 Key Enterprise Analysis: Domestic enterprises such as Yongguan New Materials have risen rapidly

The main domestic manufacturers of automotive wiring harness tapes include Yongguan New Materials, Yongle Tape, Lianyi Wiring Harness, Kemico Industrial, and Kabeli Automobile, among others. These enterprises are gradually coming to the fore in the competition with foreign brands.

Yongguan New Materials, as a leading domestic adhesive tape manufacturer, is actively laying out in the field of new materials for automotive-grade adhesive films. In 2024, its market for industrial-grade adhesive new materials and automotive-grade adhesive film new materials developed well, with sales increasing by 28.96% and 86.37% respectively year-on-year.

Despite fierce competition, Yongguan New Materials achieved operating revenue of 6.205 billion yuan in 2024, representing a year-on-year growth of 13.72%. However, due to the intensified market competition, the company's gross profit margin on sales was 7.94%, showing a downward trend.

Yongle Tape is a leading manufacturer of high-performance tape solutions for the automotive, electrical and general industrial sectors, and is a highly regarded industry leader in automotive wiring harness applications. Lianyi Wiring Harness is a professional manufacturer of automotive wiring harness winding tape series products, forming a series of products such as fabric-based adhesive tape, wear-resistant adhesive tape, and PVC wiring harness tape.

04 Investment Directions: Three major fields have the greatest potential

In the field of domestic substitution, with the rise of domestic new energy vehicle manufacturers, it has brought development opportunities to domestic automotive wiring harness tape enterprises. The certification and access cycle for automotive wiring harness tape is long, and the product added value and access threshold are relatively high. However, once the certification is passed, the customer stickiness is relatively strong.

In terms of product technology, domestic enterprises are transforming and upgrading from traditional civilian consumer-grade products to high-tech industrial-grade and automotive-grade products. Industrial-grade and automotive-grade products have a higher degree of differentiation and customization, and their gross profit margins are also relatively higher.

In terms of regional investment layout, the East China region, as a hub for the automotive industry, remains a key investment area. In 2022, the market size of automotive wiring harness tape in East China accounted for 32.9%, demonstrating a distinct geographical advantage.

The export market also shows a growth trend. In 2024, the adhesive tape industry achieved an export volume of 2.6182 million tons, representing a year-on-year growth of 20.43%. In 2024, Yongguan New Materials' export business accounted for over 70% of its main business income, indicating that the international market's demand for Chinese-made automotive wiring harness tapes continues to grow.

05 Challenges and Risks: Dual Pressures of cost and competition

The automotive wiring harness tape industry still faces multiple challenges. The proportion of raw material costs in the total product costs exceeds 75%, and the price fluctuations of major raw materials such as butyl acrylate have a significant impact on the operation of enterprises.

Competition in the industry is also intensifying continuously. In 2024, some tape enterprises witnessed a phenomenon of cutting prices to secure orders, which led to a decline in the overall profitability of the industry. Yongguan New Materials' gross profit margin in 2024 is only 7.94%, reflecting the intensity of market competition.

From the perspective of the supply chain, enterprises with a relatively large proportion of exports are at risk of changes in trade policies. Take Yongguan New Materials as an example. In 2024, the proportion of its export business in its main business income reached over 70%. Fluctuations in exchange rates and changes in the international trade environment have had a significant impact on the enterprise.

In addition, the tightening of environmental protection policies has also driven a reshuffle in the industry. The Ministry of Industry and Information Technology's "Normative Conditions for the Green Packaging Industry" clearly stipulates that solvent-based adhesive processes should be phased out by 2027, compelling enterprises to upgrade their technologies and transform towards environmentally friendly directions such as water-based adhesives.

In the next five years, as the new energy vehicle industry continues to develop, higher requirements will be put forward for adhesive tape materials, which will continue to drive technological innovation and industrial upgrading. By 2030, tapes that meet environmental protection standards are expected to account for 62% of the market share, and the defect rate of products in intelligent manufacturing demonstration factories can be controlled at an extremely low level.

Domestic enterprises such as Yongguan New Materials and Yongle Tape are increasing their investment in research and development to enhance their market competitiveness by developing environmentally friendly and high-performance products. Although automotive wiring harness tape is small, it reflects the grand picture of the transformation and upgrading of China's manufacturing industry - from relying on imports to independent innovation, from price competition to value competition. The domestic supply chain is firmly establishing itself in the high-end market through continuous innovation.

The Market for Wiring Harness Tapes for New Energy Vehicles in China has Seen a Sharp Increase, and the Investment Scale is Expected to Exceed 2 Billion Yuan by 2025

12.29.2025

The Small but Crucial Automotive Wiring Harness Tape is Breaking the Foreign Monopoly Pattern with the New Energy Wave, and Domestic Enterprises are Emerging

11.25.2025

The Automotive Wiring Harness Tape Industry is Undergoing Transformation, with Green Innovation and Domestic Substitution Becoming the Main Themes

10.29.2025

Contact Number86-27-84738038/84738036

Building 24,Xingsheng Road NO.155, Huading Industrial Park, Hannan Economic Development Zone, Wuhan City, Hubei Province

Building 24,Xingsheng Road NO.155, Huading Industrial Park, Hannan Economic Development Zone, Wuhan City, Hubei Province

jianzhongniu@lantortape.com

jianzhongniu@lantortape.com

Official Tiktok

Copyright ©2026.All Rights Reserved.Hubei ICP No. 2025129814-1

Lantor Technology (Hubei) Co., Ltd CopyrightTechnical Support: Shenyang Cloud Technology Co., Ltd